Trading

Monday, June 26th 2023

How to View Earnings and Insider Trades in the Trade Builder

Learn how to display, analyze, and trade using earnings information and insider trading activity in the Trade Builder graphing interface.

Summary

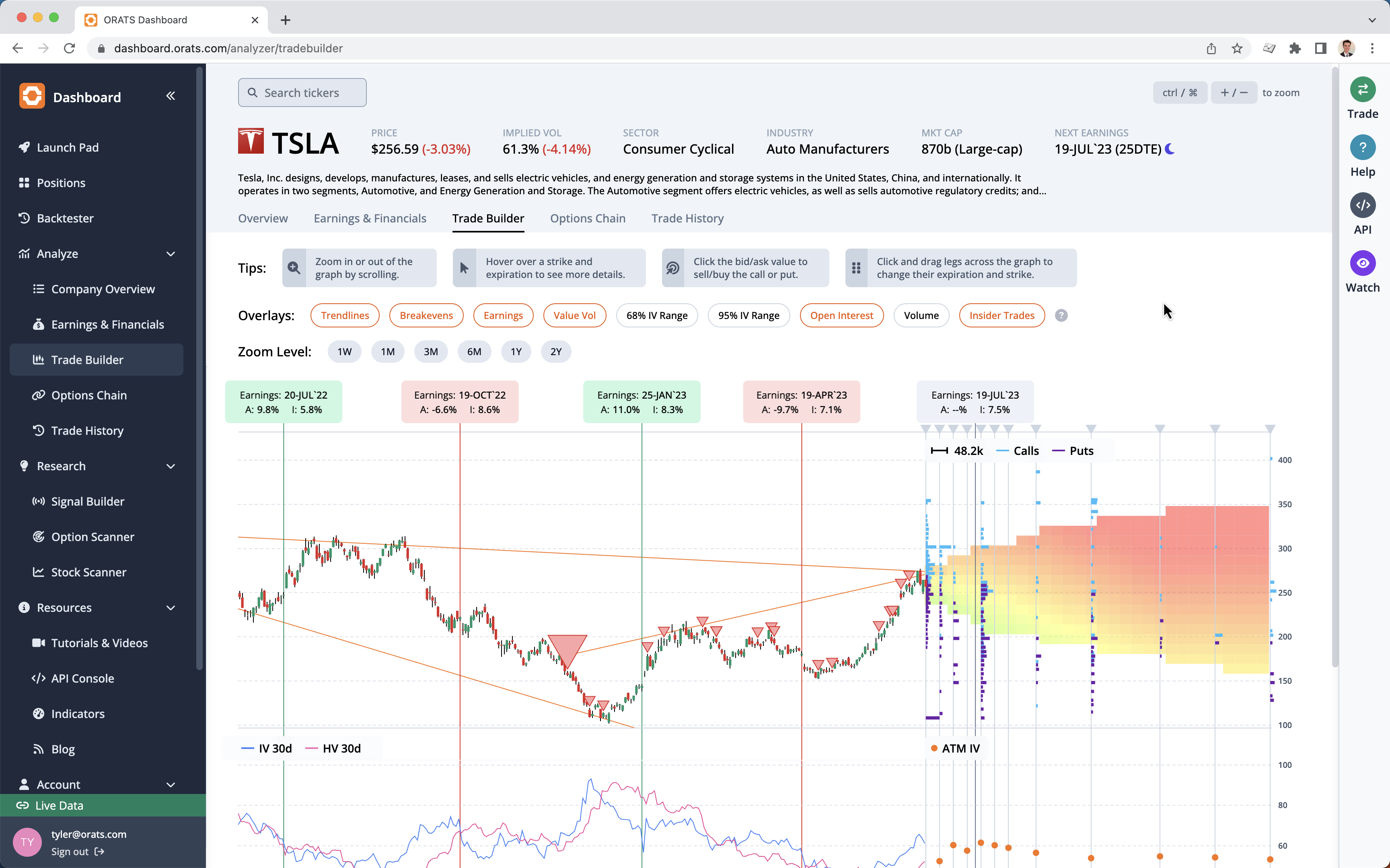

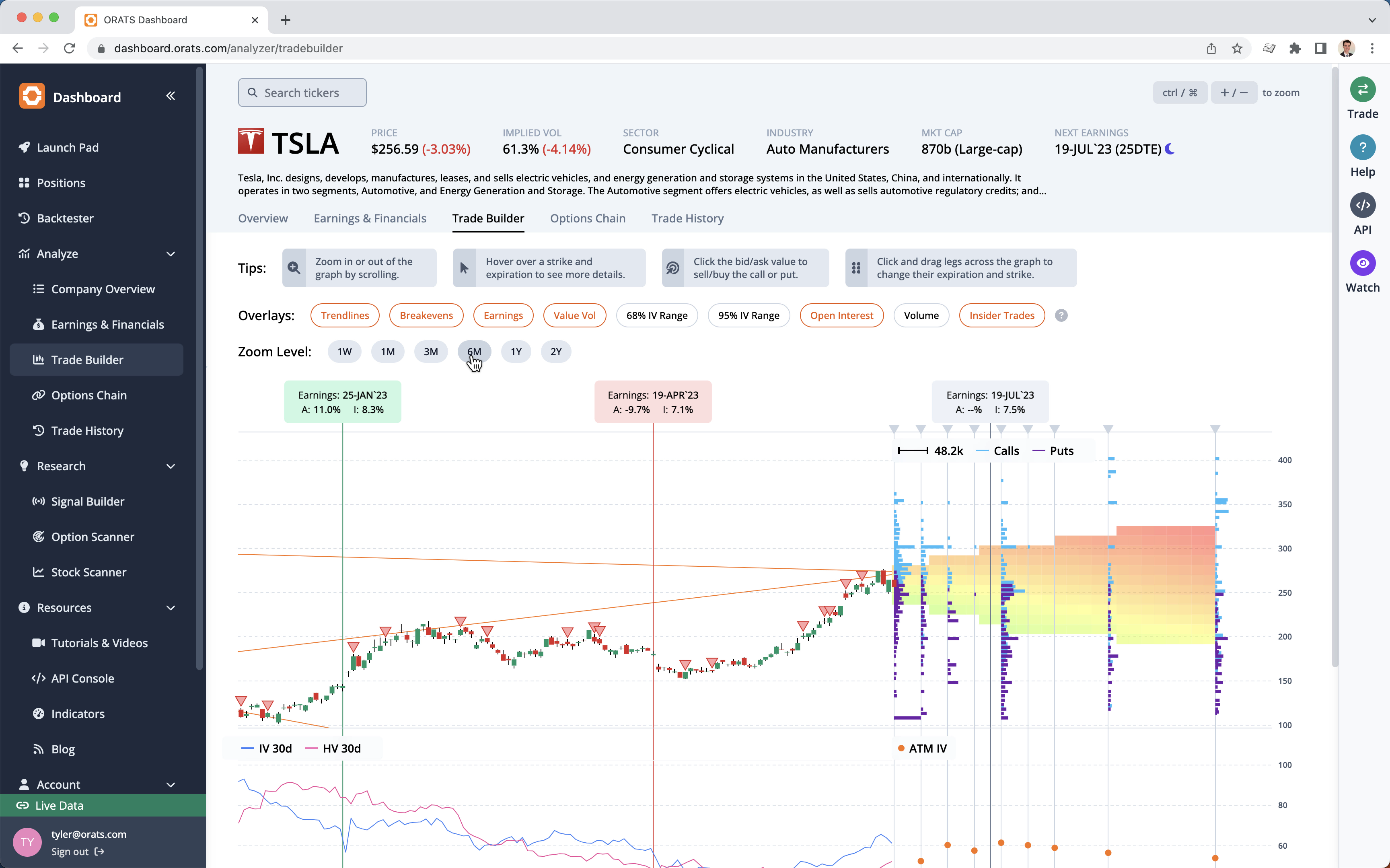

The Trade Builder is a graphing tool that provides comprehensive details of every option, including future expirations, strikes, and volatility information, as well as historical prices overlaid with trend lines, earnings information, and insider trading activity. Deciphering earnings information can help gauge market expectations and strategize next moves, while keeping an eye on insider trading activity can offer valuable insights. The user-friendly navigation features allow for flexible zooming in or out on the graph for a more detailed or broader view of the historical data.

The Trade Builder is a unique graphing tool that allows you to construct options trades interactively on a forward-looking graph, providing you with comprehensive details of every option including future expirations, strikes, and volatility information, as well as historical prices overlaid with trend lines, earnings information, and insider trading activity. This wealth of data can significantly bolster your understanding of the market, paving the way for more strategic trading decisions.

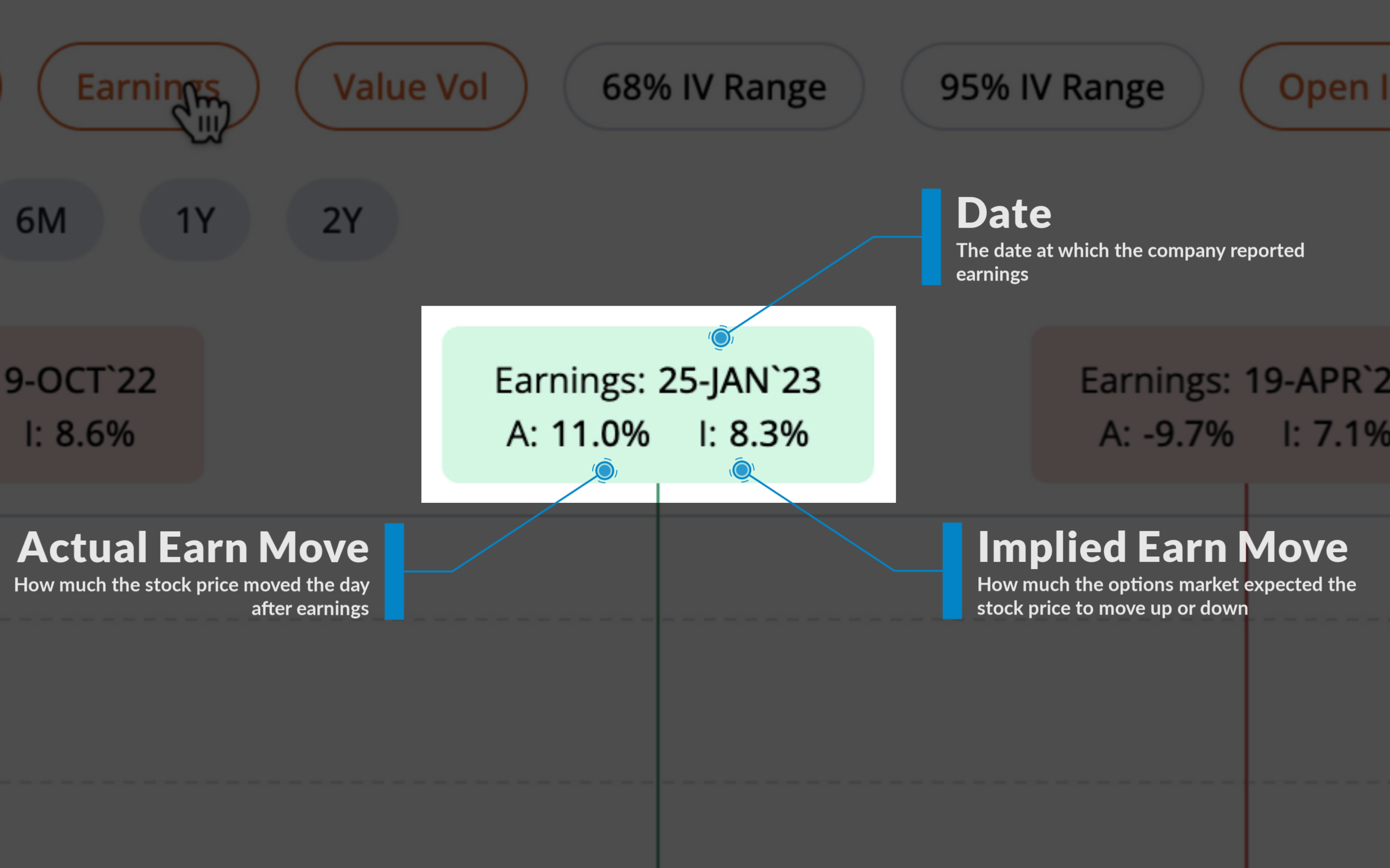

A crucial element on the Trade Builder's historical side is the earnings information. Displayed with a simple click of a button, this feature shows the date when a company reported earnings, the actual earnings move, and the implied earnings move.

One of the most utilized indicators available in Trade Builder is the implied earnings move. This shows how much the options market expected a stock price to move in any given direction. For example, if the stock price moved more than the implied move, it suggests that a long straddle strategy would have likely been profitable. However, if the stock price moved less than the implied move, a long straddle could have potentially lost money. This data can be extremely helpful in gauging market expectations and strategizing your next move.

As an options trader, keeping an eye on insider trading activity can also offer valuable insights. When an officer, director, or large shareholder of a company transacts shares, this information is required to be reported and is captured in the Trade Builder.

On the graph, these transactions are indicated, and you can view when they occurred, who was involved, and how many shares were bought or sold. The relative size of the transaction is also represented visually, with the option to mouse over the data for further details.

Trade Builder also offers flexible navigation features. You can zoom in or out on the graph for a more detailed or broader view of the historical data, as needed. This means you can easily adjust the time horizon on the graph according to your analysis requirements.

The ORATS Trade Builder brings together the tools and information necessary for savvy options trading in one easy-to-use graphing interface. So whether you're conducting an in-depth analysis or making quick trade decisions, it's a must-have tool for any options trader.

If you have any questions or need further guidance on utilizing the Trade Builder, feel free to email support@orats.com

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts